Could you be paying too much or too little Value Added Tax (VAT)? Golding Accountancy can manage and comply to the complex and changing VAT regulations. We can advise on how best to minimise VAT payments and maximise available reliefs due to your company.

For many small business owners, dealing with tax-related issues is like going to the dentist, a necessary evil. Our expert Xero accountants specialise in providing an ongoing consultant VAT function and have acted for several medium and small businesses. Any business generating revenue can register for VAT, although this is only mandatory for those which are turning over more than £83,000 per year in ‘taxable’ income. Once registered, you are required to submit returns to HMRC on a quarterly basis, and to pay the net difference between VAT due on sales and VAT recoverable on expenses to HMRC within one month and seven days.

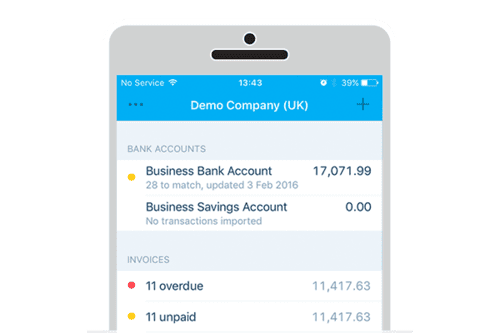

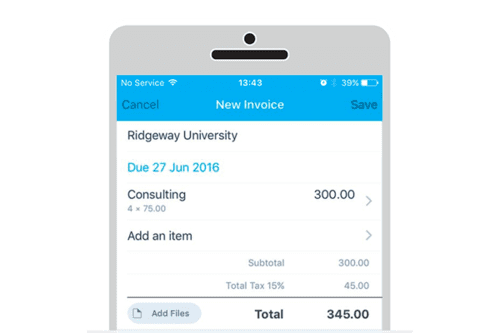

We aim to ensure that our clients receive excellent value for money. We provide professional VAT management solutions and offer a client-focussed, affordable, prompt and cost-effective service. Tracking and reporting on invoices that are both raised and paid is vital for VAT-registered businesses as these are needed to complete an accurate return and validate any VAT reclaim. All VAT invoices raised must hold detailed information including name and address, VAT number, the tax point, details of the supply being made, and the net and VAT amounts being charged.

Benefits of professional VAT Management

Financial chronicles accounting can identify and rectify VAT issues and questions:

Detailed financial records must be maintained as part of a VAT account and must be kept on file for six years. There are some alternative options which some businesses may consider, depending on their size and the type of work they are involved in, which can make the level of administration much more straightforward and reduce the amount of required record keeping when it comes to managing VAT.

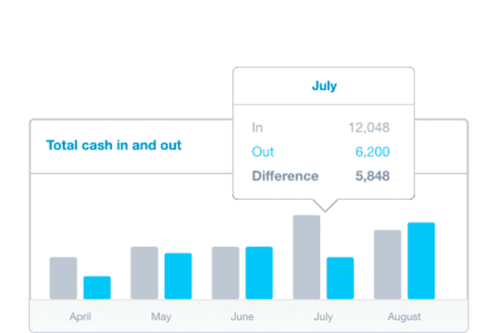

Monthly VAT returns can increase cash flow and under-recovered or over-accounted for VAT in the last four years can address this by making a claim to HMRC. Our team of VAT management experts can take over your accounts preparation and VAT management, leaving you free to focus on the smooth running of your business. We provide specialist advice on where VAT should be applied and our VAT management service ensure that there will not be any hidden costs and you can be confident in an HMRC inspection.

If you would like to discuss with a professional in more detail don’t hesitate to schedule a meeting.

We possess comprehensive knowledge and expertise in Xero, QBOs, Netsuite, and Sage, and we know how to leverage their features to simplify your accounting and tax concerns. You are welcome to contact us to learn more about our accounting, payroll, VAT, bookkeeping, and taxation services. We would be happy to customize a package that suits your unique needs and requirements.

Email at info@finacialchronicles.co.uk or give us a ring on:

+44 786 870 4020