If you would like to discuss with a professional in more detail don’t hesitate to schedule a meeting.

Accountants for UK

Accountancy Services in UK

In the UK, accountancy services are provided by firms that are regulated by professional bodies such as the Institute of Chartered Accountants in England and Wales (ICAEW) and the Association of Chartered Certified Accountants (ACCA). These bodies set ethical and professional standards for accountants, ensuring that clients receive high-quality services. Financial Chronicles is an approved employer of ACCA/

Some of the most common accountancy services provided by Financial Chronicles in the UK include:

Tax Services: UK accountancy firms provide tax services to businesses and individuals, including tax planning, tax compliance, and tax advisory services. This includes managing VAT, corporate tax, personal tax, and other taxes that businesses may be subject to.

Accounting and Bookkeeping: UK accountancy firms provide accounting and bookkeeping services to businesses of all sizes. This includes managing financial records, preparing financial statements, and conducting periodic financial analysis to help clients make informed decisions.

Payroll Services: UK accountancy firms help businesses manage their payroll processing and reporting. This includes calculating payroll taxes, preparing and filing payroll tax forms, and preparing year-end tax documents for employees.

Financial Planning and Analysis: UK accountancy firms provide financial planning and analysis services to help businesses plan for the future. This includes creating financial forecasts, identifying areas of risk and opportunity, and developing strategies to achieve business goals.

Audit and Assurance Services: UK accountancy firms provide audit and assurance services to help clients maintain compliance with accounting standards and regulations. This includes conducting audits and reviews of financial statements and internal controls.

Overall, Financial Chronicles accountancy firms provide a wide range of services to help businesses manage their finances and comply with local regulations. They play a critical role in ensuring the financial health of businesses, and their expertise can be invaluable for businesses looking to grow and succeed.

SCHEDULE A MEETING

Why Choose Our Accountants In the UK?

We could throw a million reasons why you should make us your accounting partner. However, we’ll stick with a few key points, including:

- Receive personal service from us. We can visit you at your office during or out of regular working hours, both for initial meetings and/or the collection of books. Or you can come to us; we don’t mind.

- Deadlines mean everything to us, which is why we follow such high business standards to ensure our clients are always happy with our accountancy services in th United Kingdome.

- We offer value for money and can provide fixed price accounts, with no hidden charges or surprises and the option to pay monthly. Enjoy financial flexibility with Financial Chronicles in the UK !

What’s our initial approach, you ask?

After a free consultation with us, the scope of work and its subsequent fee will be agreed upon. Unlike many other accountancy practices, we’re transparent about what we charge, and no extra amount will suddenly appear on the final bill.

BOOK YOUR CONSULTATION WITH US TODAY!

Leverage Xero For Your Business

WITH GOLDING

We have knowledge of how to make Xero work for you and make the accounting and tax headache a thing of the past. Feel free to speak to us regarding our accounting, payroll, VAT, Bookkeeping and taxation services, Let’s tailor-make a package that’s best for you.

Email at info@finacialchronicles.co.uk or give us a ring on:

+44 786 870 4020

+44 788 320 4885

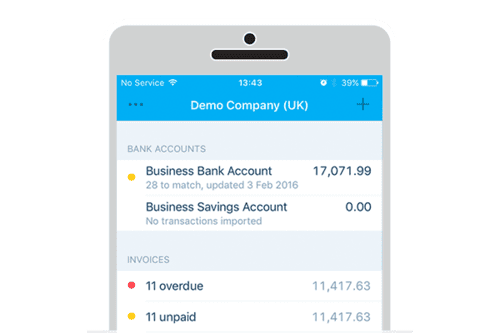

RUN YOUR BUSINESS FROM ANYWHERE

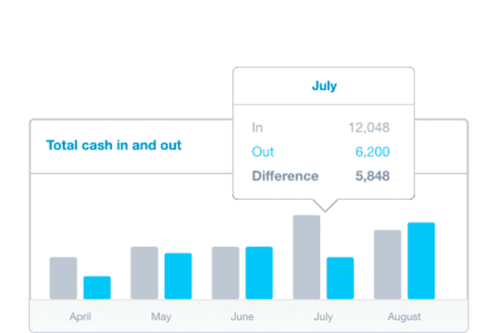

SEE YOUR CASH FLOW IN REAL-TIME

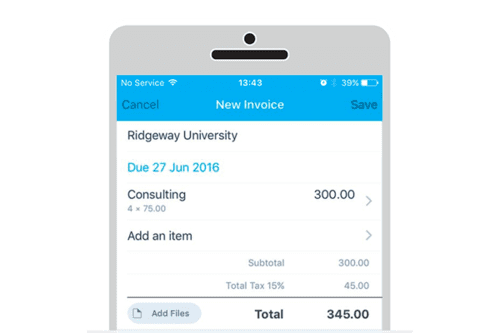

GET PAID FASTER THAN EVER

WE WORK WITH THE TOP TECH COMPANIES IN THE INDUSTRY